KOMITMEN UNTUK PERLINDUNGAN PRIMA

PRODUK SPESIAL KAMI

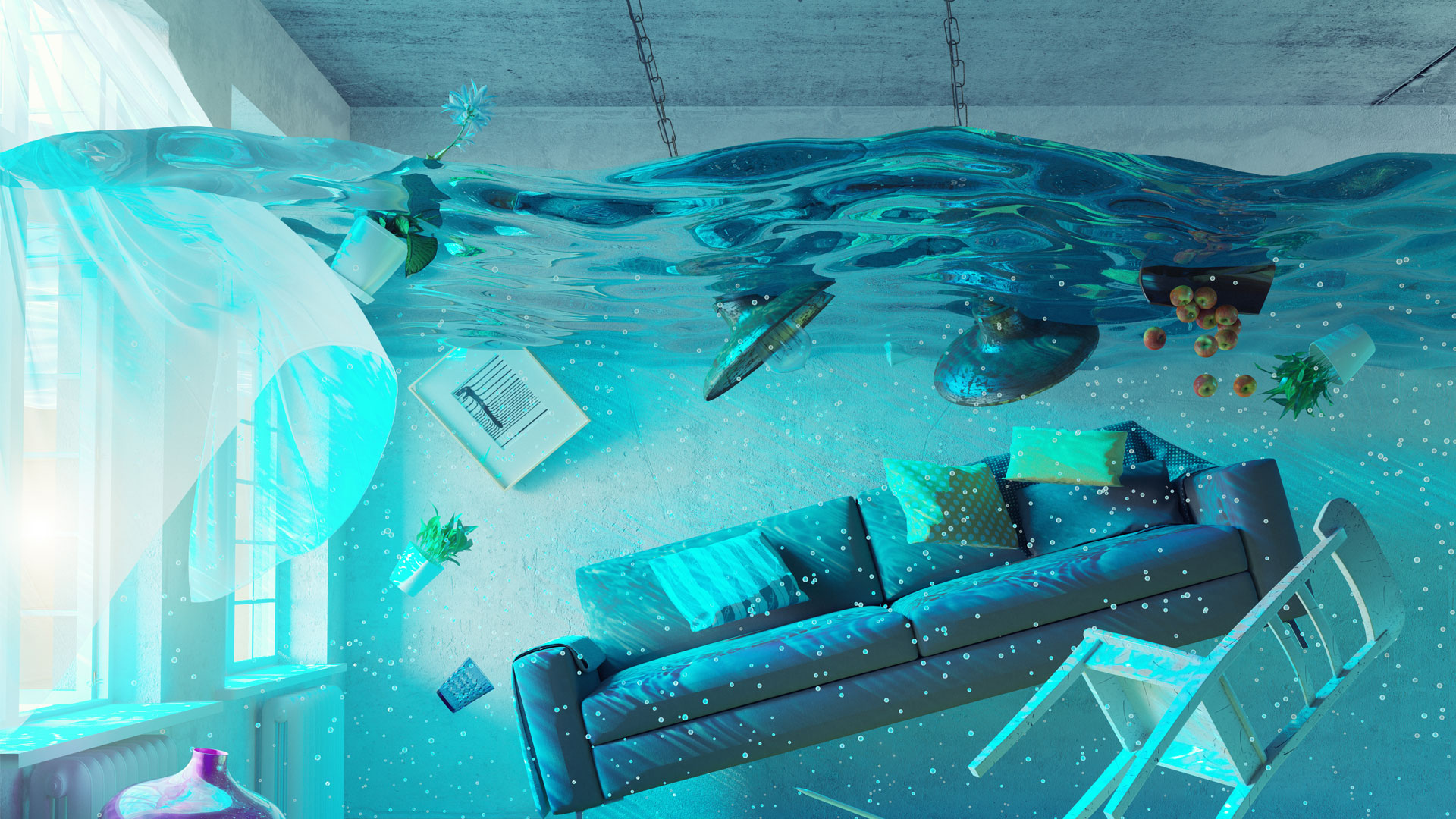

Menjawab keinginan pasar untuk menghadirkan produk retail yang sesuai dengan kebutuhan asuransi perorangan, maka PT Asuransi Dayin Mitra Tbk menghadirkan produk dengan perlindungan yang komprehensif seperti Dayin Rumah, Dayin Usaha, dan Dayin Travelmate.

PT Asuransi Dayin Mitra Tbk merupakan Perusahaan asuransi yang menyediakan berbagai layanan produk asuransi seperti asuransi kebakaran, asuransi kendaraan, asuransi uang, asuransi pengiriman (cargo), asuransi rekayasa, asuransi kecelakaan diri dan berbagai produk lainnya.

Kestabilan politik dan pertumbuhan ekonomi Indonesia yang semakin kondusif dan kompetitif, mendorong kesadaran masyarakat Indonesia untuk memiliki asuransi sebagai sarana perlindungan.

.png)